Get the free nf5 form

Show details

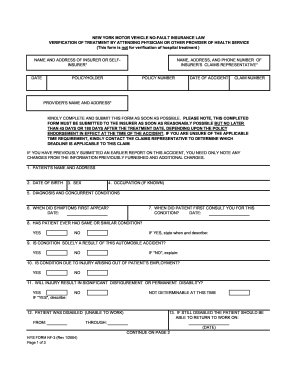

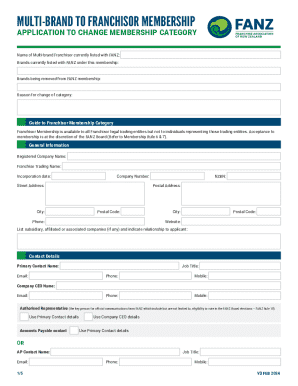

NEW YORK MOTOR VEHICLE NO-FAULT INSURANCE LAW HOSPITAL FACILITY FORM KINDLY COMPLETE AND SUBMIT THIS FORM AS SOON AS POSSIBLE. PLEASE NOTE THIS COMPLETED FORM MUST BE SUBMITTED TO THE INSURER AS SOON AS REASONABLY POSSIBLE BUT NO LATER THAN 45 DAYS OR 180 DAYS AFTER THE TREATMENT DATE DEPENDING UPON THE POLICY ENDORSEMENT IN EFFECT AT THE TIME OF THE ACCIDENT. AUTHORIZATION TO PAY BENEFITS I AUTHORIZE PAYMENT OF HEALTH BENEFITS TO THE UNDERSIGNED HEALTH CARE PROVIDER OR SUPPLIER OF SERVICES...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign does nf5 exist form

Edit your new york motor vehicle no fault insurance law form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your nbi form no 5 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing nbi form no 5 pdf download online

Use the instructions below to start using our professional PDF editor:

1

Sign into your account. In case you're new, it's time to start your free trial.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit nbi form no 5 pdf. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Create an account to find out for yourself how it works!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out nys no fault forms

How to Fill Out NF5 Form:

01

Start by obtaining the NF5 form from the appropriate source, such as a government website or a tax office.

02

Read the instructions carefully to understand the purpose and requirements of the form.

03

Gather all the necessary information and documents needed to complete the form accurately. This may include personal details, financial information, and supporting documents.

04

Begin filling out the form by entering the requested information in the designated fields. Make sure to provide accurate and up-to-date information.

05

Pay close attention to any specific instructions or guidelines mentioned for certain sections of the form, such as signatures or attachments.

06

Double-check all the entered information to ensure its accuracy and completeness. Mistakes or missing details could result in delays or problems.

07

If required, provide any additional documentation or evidence to support the information provided in the form.

08

Once you have completed the form, review it once again to be absolutely certain that everything is filled out correctly.

09

Sign and date the form as necessary, following any specified requirements for signatures.

10

Make copies of the filled-out form and any supporting documentation for your records.

11

Submit the completed NF5 form to the appropriate entity or agency as instructed, whether it is through mail, in-person delivery, or online submission.

Who Needs NF5 Form:

01

Individuals or entities who are required to report specific information to the government or regulatory authorities.

02

Examples may include taxpayers, business owners, employers, financial institutions, or organizations dealing with taxable transactions.

03

The exact requirement for the NF5 form varies by jurisdiction and the specific purpose for which it is being used. Therefore, it is advisable to consult the relevant authorities or seek professional guidance to determine if you need to fill out the NF5 form.

Fill

no fault insurance new york

: Try Risk Free

People Also Ask about nf5

What are the benefits of no-fault insurance in NY?

Basic No-Fault auto insurance coverage includes: 80% of lost earnings from work, up to a maximum payment of $2,000 per month for up to three years from the date of the accident; subject to statutory offsets for New York State disability, Worker's Compensation and Federal Social Security disability benefits.

What is a no fault nf2 in NY?

If you, or a loved one, sustained injuries from a motor vehicle accident in Buffalo, New York, or the Greater New York Area, you are eligible to file a No-Fault Claim to receive monetary compensation. The NF-2 Form is one of several forms that can be filed in the event of a motor vehicle accident.

How do I file a no-fault insurance claim in NY?

For No-Fault claims in New York State: File a crash report, preferably at the scene. Get a copy of the crash report, from the precinct or online. Send a notice of claim by certified mail to all potentially responsible parties. Read about the claims process here.

What is a NF 5?

Nitrogen pentafluoride (NF5) is a theoretical compound of nitrogen and fluorine that is hypothesized to exist based on the existence of the pentafluorides of the atoms below nitrogen in the periodic table, such as phosphorus pentafluoride.

What is an nf5?

AUTHORIZATION FOR RELEASE OF HEALTH SERVICE OR TREATMENT INFORMATION.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute nys no fault online?

pdfFiller has made it simple to fill out and eSign no fault application pdf. The application has capabilities that allow you to modify and rearrange PDF content, add fillable fields, and eSign the document. Begin a free trial to discover all of the features of pdfFiller, the best document editing solution.

Can I create an eSignature for the form 5 in Gmail?

Use pdfFiller's Gmail add-on to upload, type, or draw a signature. Your what is form 5 and other papers may be signed using pdfFiller. Register for a free account to preserve signed papers and signatures.

How can I fill out nfs form on an iOS device?

pdfFiller has an iOS app that lets you fill out documents on your phone. A subscription to the service means you can make an account or log in to one you already have. As soon as the registration process is done, upload your form 5a. You can now use pdfFiller's more advanced features, like adding fillable fields and eSigning documents, as well as accessing them from any device, no matter where you are in the world.

What is nf5 form?

The NF5 form is a regulatory document often required for the reporting of certain financial information, typically related to investments or compliance with financial regulations.

Who is required to file nf5 form?

Individuals or entities that meet specific regulatory criteria and are involved in certain financial activities or investments may be required to file the NF5 form.

How to fill out nf5 form?

To fill out the NF5 form, one must gather all required financial information and follow the provided instructions carefully, ensuring that all sections are filled out accurately and completely.

What is the purpose of nf5 form?

The purpose of the NF5 form is to ensure transparency and compliance with financial regulations by collecting necessary information from entities involved in certain financial activities.

What information must be reported on nf5 form?

The NF5 form typically requires reporting of financial activities, names of involved parties, amounts involved, and any other relevant data specified by regulatory authorities.

Fill out your nf5 form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Form 5 Drap is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.